State Farm Cd Rates

State Farm Cd Rates Jumbo

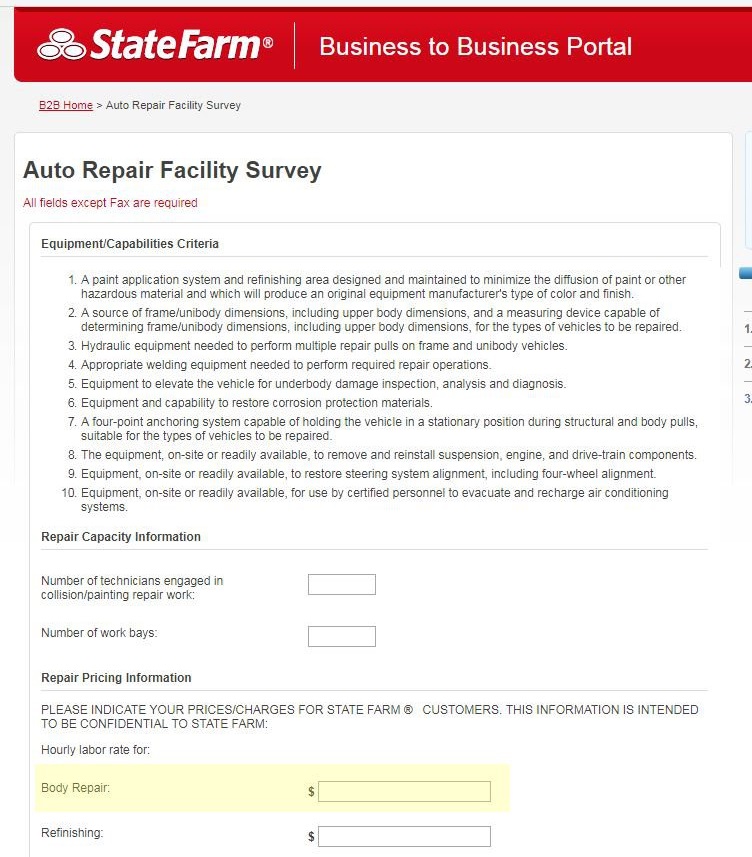

Take advantage of the current 0.75% APY with State Farm Bank Money Market Account today! In addition to the current rate from State Farm Bank, you can also take advantage of a range of great promotions from banks such as HSBC Bank, Chase Bank, Huntington Bank, Discover Bank, TD Bank, BBVA or CIT Bank. With our 10 Month CD, you'll know exactly how much you'll earn over a fixed term. Better rates available for Platinum and Platinum Plus Checking customers. This 25-Month CD allows for a longer period of investment with the same fixed rate and peace of mind over a fixed term. Better rates available for Platinum and Platinum Plus Checking customers. Apply for a Line of Credit Loan 1 Share rates are subject to change monthly (such change to be effective on the first day of each month) to reflect any changes as declared by the Board of Directors of the State Farm Credit Union during the month preceding any such change. 2 Payment per $1000 calculated on maximum term available. The rate of 2.60% is 1.21% higher than the average 1.39%. Also it is 0.15% lower than the highest rate 2.75 Updated Aug, 2019 on State Farm Bank's secure website.

| Description | APY* | Rate |

|---|---|---|

| 3 months | 0.20% | 0.20% |

| 6 months | 0.25% | 0.25% |

| 9 months | 0.35% | 0.35% |

| 12 months | 0.45% | 0.45% |

| 18 months | 0.50% | 0.50% |

| 24 months | 0.60% | 0.60% |

| 36 months | 0.70% | 0.70% |

| 48 months | 0.75% | 0.75% |

| 60 months | 0.85% | 0.85% |

State Farm Cd Rates 2020

*APY denotes Annual Percentage Yield

Rates and information are subject to change at any time. Recurring deposits may be made into the certificate through automatic transfers (ATS) only. You may set up recurring deposits through ATS within 30 days after the certificate is purchased. Deposits can be stopped or reduced at any time. This rate will be paid until the certificate matures. Your certificate will automatically renew at the rate in effect at the time of maturity unless we are contacted on or before the maturity date. Upon renewal, the term will be the same as the original term. You have ten calendar days after maturity to redeem your certificate without penalty if you do not want to renew. If the member has not contacted PSECU by the maturity date, the certificate will renew for the rate in effect on the date of maturity and for the same term as the original term. A penalty will be imposed for early withdrawal. A minimum daily balance of $500 must be maintained in order to earn the disclosed APY.

State Farm Cd Rates

This content provided is for informational purposes only. Nothing stated is to be construed as financial or legal advice. PSECU recommends that you seek the advice of a qualified financial, tax, legal or other professional if you have questions.