Andhra Bank Fixed Deposit Rates

Andhra Bank Fixed Deposit Interest Rate“Andhra Bank” was founded by the eminent freedom fighter and a multifaceted genius, Dr. Bhogaraju Pattabhi Sitaramayya. The Bank was registered on 20th November 1923 and commenced business on 28th November 1923 with a paid up capital of Rs 1.00 lakh and an authorised capital of Rs 10.00 lakhs.Our Vision is to become a significant player, providing full range of banking services through innovative customer centric products and to maximize stake holders’ valueOur mission is to work together towards delivering excellent customer service by leveraging on technology and human resources to attain world class performance standards.Interest Rates on Savings Bank Accounts :

In fact, according to the current trends, most of the banks are offering FD interest rates for non-senior citizen depositors in the range of 3%-5.4% p.a. Depending on factors like investment. At present, DCB Bank, YES Bank and Equitas Small Finance Bank is offering an interest rate of 6.75 per cent on tax-saving fixed deposits with a maturity period of five years. Following close are IndusInd Bank and AU Small Finance Bank that offers an interest rate of 6.50 per cent on five- year tax-saving FD. Andhra Bank FD Rates. A fixed deposit or FD is a type of bank account which allows you to deposit a certain fixed amount of money at a regular interval of time for a fixed period. In a fixed deposit account, you can collect the maturity amount at the end of the fixed period. The advantage of having a fixed deposit account is that you earn high. Andhra Bank is a public-sector bank that has brought some fixed deposit schemes having interest rates competitive to that of other banks. Like other banks, FD rates of Andhra Bank change from time to time depending on the bank and the general finance market.

4.00% per annum on Domestic Savings Deposits, Ordinary Non-Resident (ONR) Savings deposits and Savings Deposits under Non- Resident (External) (NRE SB) Accounts w.e.f., 03.05.2011Interest Rates on Domestic Term Deposits w.e.f., 07.10.2013Rates of Interest on Domestic Term Deposits have been revised with effect from 07.10.2013. With this revision, the interest rates offered on domestic term deposits for various periods are as underSr.No.Maturity PeriodRates of interest (%) per annumLess than Rs.15.00 LacsRs.15.00 Lacs to < Rs.1.00 croreRs.1.00 Crore to Rs.10.00 Crore

Above Rs.10 Crore to Rs.50 Crore *Above Rs.50 Crore to Rs.100 Crore *Above Rs.100 Crore *17 days to 14 days #5.00 5.00 5.00 5.00 5.00 5.00 215 days to 45 days5.00 5.00 5.00 5.00 5.00 5.00 346 days to 90 days8.10 8.10 8.10 8.10 8.10 8.10 491 days to 179 days8.25 8.25 8.25 8.25 8.25 8.25 56 months to < 9 months9.10 9.10 9.10 9.10 9.10 9.10 69 months to < 1 year9.10 9.10 9.10 9.10 9.10 9.10 71 year to 443 days9.10 9.10 9.10 9.10 9.10 9.10 8444 days9.409.409.409.409.409.409445 days to 2 years9.10 9.10 9.10 9.10 9.10 9.10 10Above 2 years to 3 years8.75 8.75 8.75 8.50 8.50 8.50 11Above 3 years to less than 7 years 7 months8.75 8.75 8.75 8.50 8.50 8.50 127 years 7 months9.25 9.259.259.259.259.25

Above Rs.10 Crore to Rs.50 Crore *Above Rs.50 Crore to Rs.100 Crore *Above Rs.100 Crore *17 days to 14 days #5.00 5.00 5.00 5.00 5.00 5.00 215 days to 45 days5.00 5.00 5.00 5.00 5.00 5.00 346 days to 90 days8.10 8.10 8.10 8.10 8.10 8.10 491 days to 179 days8.25 8.25 8.25 8.25 8.25 8.25 56 months to < 9 months9.10 9.10 9.10 9.10 9.10 9.10 69 months to < 1 year9.10 9.10 9.10 9.10 9.10 9.10 71 year to 443 days9.10 9.10 9.10 9.10 9.10 9.10 8444 days9.409.409.409.409.409.409445 days to 2 years9.10 9.10 9.10 9.10 9.10 9.10 10Above 2 years to 3 years8.75 8.75 8.75 8.50 8.50 8.50 11Above 3 years to less than 7 years 7 months8.75 8.75 8.75 8.50 8.50 8.50 127 years 7 months9.25 9.259.259.259.259.25 13Above 7 years 7 months to 10 years8.75 8.75 8.75 8.50 8.50 8.50# For deposits of Rs.1.00 Lac and above.^For deposits of above Rs.10.00 Crore, depositors are requested to contact their respective branches for obtaining necessary permission from Head Office.

13Above 7 years 7 months to 10 years8.75 8.75 8.75 8.50 8.50 8.50# For deposits of Rs.1.00 Lac and above.^For deposits of above Rs.10.00 Crore, depositors are requested to contact their respective branches for obtaining necessary permission from Head Office.$Depositors are requested to note that deposits of above Rs.10.00 Crore will be accepted by branches subject to administrative clearance from Head Office

* For Deposits of above Rs.10.00 Crore, branches should obtain permission from General Manager, Corporate Planning Department, Head Office before accepting the Deposit.

For Senior Citizens, the rate of interest is 0.50% higher for all maturity periods. Existing / Retired Staff are eligible for additional rate of interest as per rules.FCNR(B) Deposits : Interest Rates w.e.f., October 01, 2013The revised interest rates on FCNR [B] Deposits with effect from October 01, 2013 are as under :Currency1 Year & above but less than 2 Years2 Years & above but less than 3 Years3 Years & above but less than 4 Years4 Years & above but less than 5 Years5 years NewExistingNewExistingNewExistingNewExistingNewExistingUSD2.63[2.67]2.48[2.57]4.77[4.95]5.16[5.38]5.53[5.77]GBP2.87[2.87]2.83[2.84]5.12[5.13]5.44[5.45]5.71[5.73]EUR2.47[2.48]2.57[2.64]

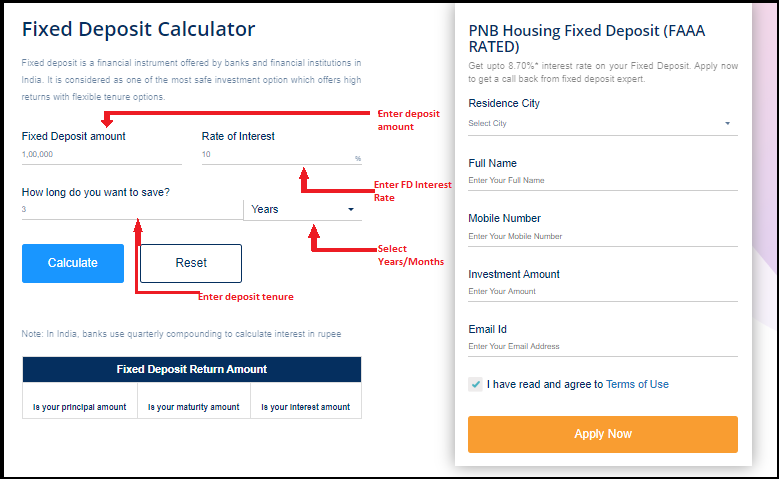

NewExistingNewExistingNewExistingNewExistingNewExistingUSD2.63[2.67]2.48[2.57]4.77[4.95]5.16[5.38]5.53[5.77]GBP2.87[2.87]2.83[2.84]5.12[5.13]5.44[5.45]5.71[5.73]EUR2.47[2.48]2.57[2.64]Andhra Bank Fixed Deposit Calculator

4.77[4.87]5.00[5.13]5.24[5.36]CAD3.49[3.37]3.47[3.56]5.73[5.83]6.01[6.11]6.24[6.34] AUD4.52[4.51]4.79[4.76]7.08[7.07]7.39[7.39]7.61[7.63]JPY2.41[2.41]2.26[2.27]4.29[4.31]4.34[4.36]4.41[4.45]CHF2.24[2.24]2.19[2.23]4.33[4.39]4.52[4.60]4.73[4.82]DKK

AUD4.52[4.51]4.79[4.76]7.08[7.07]7.39[7.39]7.61[7.63]JPY2.41[2.41]2.26[2.27]4.29[4.31]4.34[4.36]4.41[4.45]CHF2.24[2.24]2.19[2.23]4.33[4.39]4.52[4.60]4.73[4.82]DKK 2.66[2.67]2.82[2.89]5.04[5.11]5.30[5.41]5.54[5.67]NZD4.92[4.93]5.45[5.45]7.87[7.86]8.15[8.15]8.37[8.39]SEK3.33[3.40]3.56[3.69]5.82[5.97]6.11[6.21]6.23[6.40][Figures in brackets denote previous month interest rates]

2.66[2.67]2.82[2.89]5.04[5.11]5.30[5.41]5.54[5.67]NZD4.92[4.93]5.45[5.45]7.87[7.86]8.15[8.15]8.37[8.39]SEK3.33[3.40]3.56[3.69]5.82[5.97]6.11[6.21]6.23[6.40][Figures in brackets denote previous month interest rates]The above interest rates on FCNR (B) Deposits are applicable only to the fresh and renewed deposits from October 01, 2013.

NRE ACCOUNTS With effect from 16.09.2013Rates of interest on NRE term deposits have been revised with effect from 16.09.2013 With this revision, the interest rates offered on NRE term deposits for different maturity periods are as underPeriodRate of Interest (%) p.a.Less than Rs.1 CroreRs.1 Crore to Rs.10 Crore1year to 2 Years9.009.00Above2 Years – up to 3 yearsDeposit Interest Rate

9.159.15Above 3 Years – up to 5 years8.508.50Above 5 Years- up to 10 yearsFixed Deposit Rates In India

8.508.50The revised interest rates are applicable to all fresh deposits and renewals of the existing deposits with effect fromKarnataka Bank Fixed Deposit Rates

16.09.2013Andhra Bank Fixed Deposit Rates 2021

*For Deposits of above Rs. 10.00 Crore branches should obtain permission from General Manager, Corporate Planning Department, Head Office before accepting the Deposit.

Bank Deposit Rates In India